On the close of market on Friday, Daylight Energy had a market capital of CDN $976.9 million and a book value (according to TD Waterhouse website) of $6.06. With the proper approvals, Sinopec will buy it for CDN $ 2,200 million which comes to CDN $10.08 per share.

Daylight Energy is a company that has similar assets, such as a large undeveloped Cardium base, to Petrobakken. The difference is that Daylight has greater natural gas weighting than Petrobakken, and given the current commodity prices, Petrobakken should probably be more valuable. But the thing that makes Daylight most like Petrobakken is the current debt load. According to Bloomberg:

Investors feared Daylight’s relatively high debt load compared to peers, combined with a fall in oil prices, would crimp earnings, Geoff Ready, an analyst with Haywood Securities LLC in Toronto, said in a telephone interview. Daylight has total outstanding debt of C$872.5 million, according to data compiled by Bloomberg.

In this respect, Daylight is very much like Petrobakken–the market has shunned it for the same reason. While both companies pay a great dividend, have great cash flow and sit on large, very valuable land bases, Mr. Market has spurned them and thrown them under the bus. This is what makes them a great value investment. I have written about book value in previous posts (e.g., here), that the price of a private sale of a company which has positive cash will never fall short of the book value of the company. Unfortunately, the price for Daylight was only a small premium above book–just about $4 per share. This is the true value of the company, not what Mr. Market is willing to pay but what industry insiders (such as Sinopec, a large Chinese Petroleum company), who would buy the business outright, would pay.

Therefore, I would like to assign a market value to PBN based on the same metrics (in CDN $$; book value from the TD Waterhouse website):

Daylight: book value $6.06; sale price 2.2 billion or $10.08 per share; sale price as a percent of book = 166%

Petrobakken: book value $17.43; $28-29 per share (i.e., 166% above book price)

Now ultimately we have in this offer from Sinopec a fairer evaluation of the value of a Canadian dividend paying intermediate oil company than what Mr. Market is providing. I would think that if you want to get in on Petrobakken or any other CDN intermediate oil company, it may be too late to do so based on the prices that we’ve seen in the last two weeks. I’m holding my ground.

Furthermore, I would like to say that in the global monetary crisis that politicians and central banks will resort to currency devaluation to solve their problems–i.e., they will inject liquidity by recapitalizing banks, buying up troubled assets, etc. The Chinese holders of debt are now in search for quality assets based on resources, and they are getting a steal with this offer to Daylight. Personally, I am glad for the offer. But as a shareholder of Daylight Energy, I will probably vote against the deal (provided that I continue to hold until the vote).

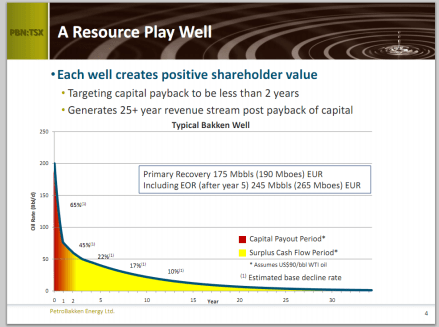

Nota Bene postlude: Finally, I would add that this sale seems to repudiate the method of evaluating Petrobakken using only proven reserves (see here, here and here). The Chinese experts have decided that the land is worth something–a lot more along the lines of the industry experts in Canada such as the CEOs of Petrobakken and Daylight Energy. I would say that this sale makes some of us, who focus on the land base and the oil in the ground and such metrics as low book/price, look a lot smarter than some would allow. A certain blogger offered some pretty self-confident and disparaging comments about how I was gonna lose money on Petrobakken and how I didn’t know what the hell I was doing. To be sure, I’ve already lost a ton of money, but $25 is my top price for the company ($27 put minus) as I have averaged down from there (my average price is much lower). I’ll continue to collect a nice dividend on all my shares until a buyer takes it out for $28+ or the market realizes what it’s really worth.