I revealed offline to Mich at Beating the Index how much my portfolio (87%) is weighted towards oil and gas stocks, and only C.J.’s (my wife’s) defined contribution plan is in a balance fund. He wrote: “Your portfolio is high risk indeed! I imagined you would have some bonds and more utilities, you surprised me really …” So I even managed to surprise another junior oil investor with my portfolio.

But let’s consider that conventional styles of investing are too rigid. They present stereotypical strategies for conventional times. If Bruce Lee had been a financial advisor, he would have advised his clients to adapt fluidly to the market–to anticipate the market’s moves and to respond in a way suited to each individual. There are no recommended trades, for each investor is unique, with a unique set of risk tolerances, liquidity and investment goals.

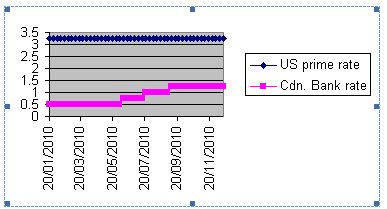

I am an inflationista. There is no doubt in my mind that Bernanke is creating money faster than the credit bubble is deflating; nor do I have any doubt anymore that the Bernanke Put is for real: no matter how fast credit deflates, Bernanke promises to pump it back up with fiat money. Now the Bank of Canada wants to create inflation, albeit only 2%, but that they also want desperately to keep the loonie on par with the greenback; and with these two strategies, governor Mark J. Carney will not be able to control run away inflation in Canada. Indeed, one could argue that the Canadian housing market has already run away from him. So now I have been investing for the last two years believing that hyperinflation is our opponent, and my jeet kune do moves must adequately anticipate and respond to that reality.

Consider these conventional strategies and how they cannot possibly succeed in time of hyperinflation:

(1) Get out of debt; (2) maintain a balance portfolio; (3) diversify your portfolio; (4) Subtract your age from 100 and this is the percentage of stocks vs. fixed income; (5) Real estate is always a great investment.

(1) Get out of debt.

Debt is always very bad if it is high interest consumer debt (credit cards, lines of credit). But for many people their mortgage is their best protection against hyperinflation–the currency can lose value much faster than you pay off the debt or interest rates can go up. Creditors lose in inflationary times, and so it stands to reason that debtors can win, provided that their debt is not spent on frivolous consumer goods.

(2) Maintain a balanced portfolio.

A balanced portfolio puts the emphasis on having stocks for growth and fixed income for safety. But it is questionable whether stocks in general are a good hedge against inflation. Warren Buffet wrote an article during the height of the last great inflationary period (1977, Fortune Magazine): “How inflation swindles the equity investor“. Fixed income investments are a disaster during hyperinflation, especially today, with the rate of return being so pathetic due to artificially low interest rates.

(3) Diversify your portfolio.

I am not sure that this strategy works in conventional times, supposing that such times ever exist. Diversification is not the same as not putting all your eggs in one basket. My portfolio includes debt, real estate, oil and gas, and gold mining companies. But it doesn’t include anything in aviation because my C.J.’s business is in aviation maintenance. So you won’t see me investing in Bombardier, Boeing, Air Canada or West Jet, because if one company goes down, it can have a domino effect on the entire industry. That’s not putting all your eggs in one basket. But those who advocate diversification suggest that the investor either own an index fund or diversified mutual fund, or a roughly equal number of stocks in each of the major sectors of the economy. I am pretty sure this will only lead to pretty mediocre results. I’ve noticed over the years that most investor billionaires are barely diversified, but have made their money in highly concentrated moves: for example, Warren Buffet is mainly an insurance guy. John Paulsen shorted sub-prime mortgages then bought gold. Sometimes it is better to get to know one or two industries really well, and stick to what you know.

(4) Subtract your age from 100 and this is the percentage of stocks vs. fixed income.

This bit of conventional wisdom has cost people a lot of money. The last two years has provided pathetic yield on fixed income and meanwhile we’ve been in a great bull market. Hyperinflation is going to wipe out whatever seniors have left and they’ll be saying a final “good bye” to their wealth. The reason why this strategy is wrong is it has an imaginary understanding of what is a high risk investment. Stocks are considered high risk and fixed income, low risk. But in hyperinflation, there is nothing more certain to destroy a portfolio than fixed income investments.

(5) Real estate is always a great investment.

The sub-prime mortgage crisis has done much to destroy this myth. For me, real estate has been a wash in the last two years. The rental house we bought is up $70,000; but the commercial building in Texas which I bought with my brother has zero equity, is not breaking even, and $70,000 of my initial investment is basically a write-off. But many people think that real estate will maintain its value in a time of hyperinflation. Gonzalo Lira trounces that myth in an article demonstrating that during hyperinflation the high interest rates and the unwillingness of creditors to lend out a rapidly devalued currency, destroys real estate prices.

Meanwhile, as of this moment, my concentrated jeet kune do portfolio is 86% above book. Commodities go up during hyperinflation; so my stocks are nearly all in Canadian commodity companies (oil and gas, gold, and sugar).