UPDATE October 4, 2011: Devon Shire discusses the most recent news coming from Petrobakken and I agree with his sentiments expressed there: http://seekingalpha.com/article/297554-is-petrobakken-in-play

The market has punished Petrobakken (PBN), not on any substantive news regarding the operations of the company, but on a downgrade by BMO:

BMO downgraded PetroBakken (C$8.22, -C$1.12, -12%) to underperform, saying “with a dividend policy that is looking increasingly unsustainable, PetroBakken continues to increase debt to levels that may be difficult to recover from.” It also said potential funding sources for the company may not be as readily available as in the past, given financial-market turmoil. PetroBakken is owned 59% by Petrobank Energy (C$8.16, -C$1.17, -13%), which is also down Wednesday.

As a consequence of this and the general market weakness in the last few weeks, Petrobakken has fallen precipitously in market price, from a 90 day intraday high of $15.11 to its close yesterday at $6.40. It may fall still further, as some bullboarders have suggested it could go as low as $3.00.

Here are the main reasons that I’ve heard for pessimism:

(1) The debt now stands at 1.1 billion plus 0.75 billion in convertible debentures. The fear is that the company will have to stop paying out the dividend.

(2) Weakness in world oil prices. This actually should be stated as fear that there will be weakness in the oil price.

(3) The world-wide monetary crisis continues, and a general credit collapse could result in PBN’s lender recalling its 1.1 billion dollar loan.

(4) Petrobakken has paid way too much for its land base.

(5) The business model for Petrobakken is unsustainable because of fast decline rates for wells.

(6) Investors and would-be analysts are worried that something else is wrong that the company isn’t telling us but about which Calgary insiders are aware. (Of course I know of no professional analyst who has made such an accusation).

These fears aside, here are my reasons for bullishness on the company and why I see it as a value investment and not a “value trap” as some investors have suggested.

(1) Petrobakken has two major land bases on which they have identified hundreds of drilling sites, in the Bakken and the Cardium. There are billions barrels of oil in these fields which oil companies have identified after several decades of vertical drilling. Petrobakken is on the leading edge of new technologies to produce these resources, including horozontal bilateral and trilateral drilling and multi-fracking, which will make it possible to extract more oil than possible with vertical drilling alone. But because these are already explored oil fields, drilling is de-risked–this is not wild-catting–i.e., drilling to determine if oil is in the ground, but drilling in oil fields that are already well-analyzed.

(2) Petrobakken already has excellent cash flow despite slow downs in production caused by bad weather. They are still confident to achieve their exit production estimate (46-49,000 bpd) by the end of 2011. If they achieve this objective, the share price could easily be around $20 per share or higher (earlier in the year PBN reached $23 on news of the estimated exit rate). The price to cash flow at yesterday’s close was an amazing 2.1x (source TD Waterhouse).

(3) The dividend at almost 15% after the share price drop, now will pay you to wait for it to go back up. While BMO is not certain that Petrobakken can maintain its dividend, the CEO John Wright hit back hard, in speaking with the Calgary Herald.

“The dividend is put in place because of the business philosophy of the company,” Wright said. “When there’s a short-term down spike people question if you should cut the dividend, but if we put our heads down and deliver on our program then the likelihood is that in the future we can possibly increase the dividend.” Read more: http://www.calgaryherald.com

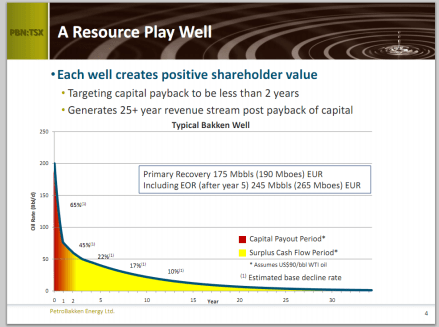

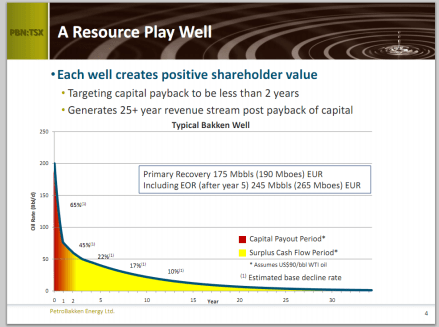

(4) The business model, about which Wright speaks, makes sense to me. It is true that initial funds up front for drilling result in debt at the beginning (Petrobakken is still a young company), and it is true that the production rate drop off is rapid in the first few months, but it is also true that the net-back (profit after expenses) for each well is very high and that the first few months of production pay for all the drilling expenses; then the wells continue to produce at a low rate for many years, providing a continuous flow of cash as a return on investment.

(5) Enhanced Oil Recovery promises to make it possible to extract as much as 20% higher oil than suggested by the current method of calculating reserves. Devon Shire writes:

For example Canadian producer Petrobakken (PBKEF.PK) has reserves booked assuming a 5% recovery in its Bakken play, but believes that eventual recoveries will be 25%. I’d say Petrobakken might be exaggerating if it weren’t for the fact that its nearest rival Crescent Point Energy (CSCTF.PK) is suggesting recoveries will be 30%.

(6) PBN has non-core land assets that it could sell if it runs into cash flow problems.

(7) PBN now has a very low share price to book value ratio 0.4. TD Waterhouse lists book price at $17.43. In the end, a company that has excellent cash flow, increasing production, and high book value, will continue to add value to shareholders. (Book value equals assets [land leases, equipment, infrastructure, buildings, cash on hand] minus liabilities [bank debt, convertible debentures]). I stick to the principle of value investing as taught by Benjamin Graham in his book The intelligent investor. If you can buy a company at book value, you are getting the future profits of the company for nothing. If you pay less than book value, unless the company is losing money, you are getting a percentage of the assets for nothing at all.

My plan is to continue selling put options on PBN while there is weakness in the share price. I’ve lost a lot of money on PBG/PBN already, but my experience in oil investing tells me to be patient, hold on, and become greedy when this kind of market madness sets in. I can’t be sure that tomorrow won’t be the apocalypse, or worse, that the bottom will fall out of oil prices. But it is a risk I think is worth taking.

Disclosure: I am long PBG, PBN, and getting longer