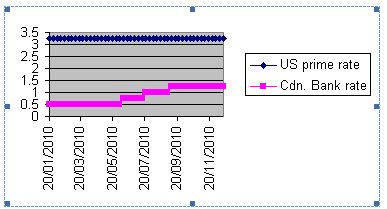

UPDATE 2: I asked Denis, my economist friend, how much of the US treasuries is owned by the Canadian government and how much would be owned by the private sector, and he suggest consulting the Bank of Canada balance sheet. It is clear that the total assets on the balance sheet are 60.8 billion, which means that there is no way that the government of Canada could have lent $134 billion to the US, and that most of the ownership of these US securities must be in the Canadian private sector and can be explained by covered interest arbitrage. Nevertheless, the reason why this arbitrage happens is because the Bank of Canada has kept the interest rates at low levels and is therefore to blame if the loonie is inflating like crazy. Denis provided me with the following chart of interest rates:

UPDATE: Thanks to the comment by blogger 101 Centavos, I finally asked my local Canadian economist if he could tell me what the number $134 billion means. He says it is not the Canadian government alone that holds this debt, but all Canadian holders both sovereign and private. I am going to try to reach him by telephone for clarification. Meanwhile, in the words of the ever opinionated Emily Latella of Saturday Night fame, “Never mind”.

[Please note: the updates above are intended to substantially correct what follows, which is the original post]

I am thinking about writing a blog for the American Thinker about the announcement that China would spend another 5.4 billion in the Canadian resource sector, this time to buy 5.4 billion of Encana’s natural gas holdings. My view is that China’s purchases of Canadian resources is more about diversifying themselves out of US treasuries. But I found a table updated in November 2010, which shows that the Chinese have actually increased their US treasuries by $265.3 billion since November of 2009 (the chart only goes back that far). Meanwhile, one stat jumped off the page. In that same period, Canada has increased its holdings of US debt by $84 billion! I am shocked.

Canadians greatly fear the death of the manufacturing sector. So now they will tolerate this. But I am dismayed and shocked that our government is manipulating the Canadian dollar so that it will not rise against the US. The immorality and the bad management of this situation is beyond words.

A couple years ago, I thought that given the bad fiscal policy of the US government would lead to the loonie soaring against the US dollar. But now I see that rather than allow that to happen, the Canadian government is subsidizing the American lifestyle and the American bubble. So that finally explains to me why the loonie remains at par and why price inflation is slow to happen in the US–why price inflation is happening in Canada the same as elsewhere in the world.